The last two sections of the IRA series were the heavy meat and potatoes of my 4-part IRA series, let’s get to dessert, shall we? So far, we have discussed what IRAs are and what they can do for you. We have also discussed how contributions and distributions typically work. What happens if there is an excess of what is supposed to be contributed into an IRA?

There are a number of ways that an IRA can receive an excess contribution and, if left unchecked, can cost you a six percent penalty on the excess contribution. The IRS provides specific procedures for removing excess contributions. Annual Contributions are excess contributions if the exceed the statutory contribution limit or the amount that the owner is eligible to contribute. If discovered before the tax return due date, with any extensions, the IRA owner may remove the excess without incurring the six percent penalty. The IRA owner may also distribute valid (not excess) contributions before the tax return due date, this is called a “deemed excess”.

Sometimes there are ineligible assets such as RMDs from their IRA/retirement plan accounts. Ineligible rollover amounts become regular contributions to IRAs and financial organizations must report only eligible rollover amounts as regular contributions. If the IRA owners are not eligible to contribute or have already made their annual contribution these regular contributions become excess contributions.

The IRA owner must decide how to correct their contributions. The allowed method depends on whether the excess contribution is corrected on or before the owner’s tax return date plus extensions or after the deadline. If it is corrected before the deadline, the six percent penalty will not apply and if it is not caught in time the owner must pay the six percent for each year that the excess remains after December 31. The extended deadline is generally October 15th., in addition, financial organizations can document elections of the IRA owners’ excess contributions on the proper authorization/ recharacterizations to be reported to the IRS.

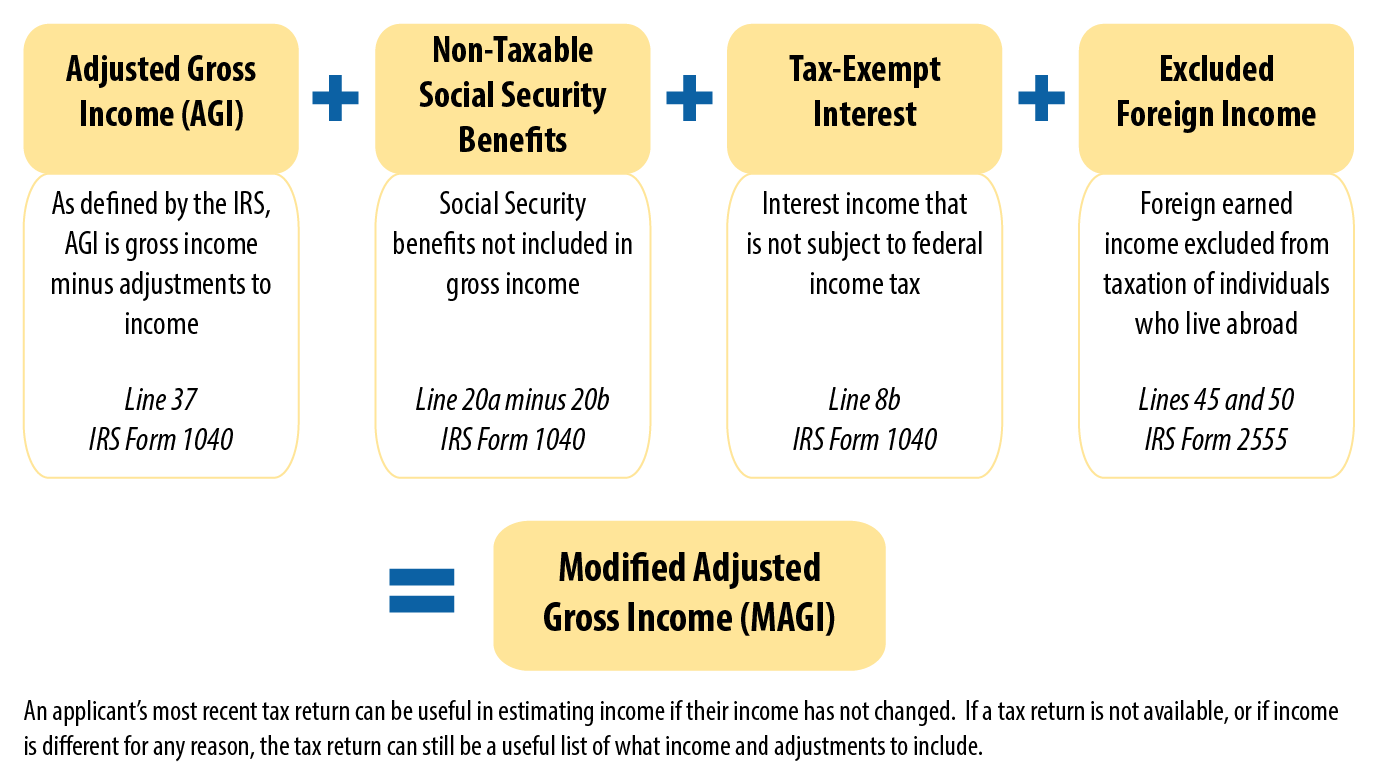

Excess contributions removed on or before the deadline must be removed with the NIA (net income attributable). Many financial organizations assist IRA owners in calculating the NIA by using excess contribution form or other means. IRA owners have with eligibility being determined by an individual modified adjusted gross income can also utilize recharacterization to handle excess contributions. Roth IRA excess due to MAGI restrictions can generally be converted into a traditional IRA. Income restrictions do not apply to traditional IRA contributions, although certain restrictions exist for deductions in this case. IRA owners may elect to recharacterize valid contributions as well.

After the deadline IRA owners can carry the excess forward by the owner treating the excesses an eligible contribution for the subsequent year and address it on their income tax return. The financial organization can also report it for the year of the contribution on a form 5498 but not do any additional reporting for the amount carried over for subsequent year contributions. The owner can also elect for the financial organization to distribute the excess amount but not the NIA or report it on the form 1099-R.

That concludes my IRA series. I hope you learned some valuable information on IRAs. These are amazing savings tools to help supplement your retirement savings. Please take advantage of these tools for your benefit. That’s all for now until the next time folks, invest wisely. Ciao!