A common tactic utilized to build a credit history is typically acquiring a credit card of some sort. this along with other credit building programs begins one’s journey for getting into a more favorable credit range. Credit card usage is a factor that helps with establishing a score, but there are things about the usage that one must know.

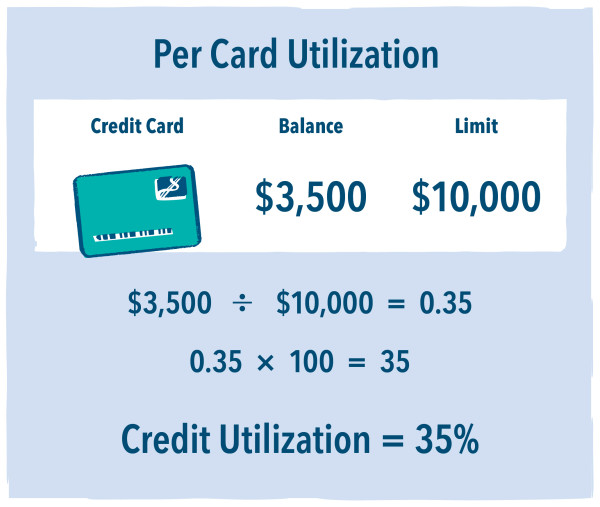

A credit card is a revolving tradeline (a trade line that when it is used and repaid you acquire a certain amount of the credit back). Credit cards have a capacity of use that displays how much of the overall limit has been used in a specific period. Credit utilization measures the balances you owe on your credit cards relative to the cards’ credit limits. If you never use your credit cards and there’s no balance on them, your credit utilization would be zero. If you typically carry a balance on one or more cards, you are ‘utilizing’ some of your available credit and credit score providers will take note. Credit utilization is a key piece of your credit score puzzle. Both FICO and Vantage, two big credit scoring agencies, list credit utilization as the second highest factor they consider when determining credit score. If your utilization ratio is high, it indicates that you may be overspending and that can negatively impact your score. This utilization ratio, as a rule of thumb, is recommended to be around 30 percent or less and is calculated by the total amount of card balances vs the amount of available credit. This means not maxing out existing credit cards. This utilization ratio can be improved by a variety of methods including, but not limited to; paying down current debt past the minimum payment, consolidation of credit card debts, getting another credit card, getting a credit limit increase, or leaving open existing cards once they’re paid amongst other methods.

Now that you know how to improve your credit utilization, it’s important to keep track of your progress. Check your credit card balances monthly and keep tabs on your utilization ratios. Many card issuers offer balance alerts via text or email, making it even easier to prevent your utilization ratio from creeping up. Monitoring your credit score can also provide motivation to keep your utilization in check. This was a short lesson, but vital nonetheless. Until the next time dear reader. Excelsior!