In my realm of expertise, I have been exposed to credit ranges across the spectrum. Some are great, some are good, some are ok and some need work and that’s alright with me. Credit is something that some treat like a sprint, but it truly is more of a marathon. Some treat some items on their credit (collections, current payment history, credit card limits, etc.) as an individual guitar solo rather than looking at all the items on their credit report as a symphony. One common thing I come across is a combination of income and credit. You could make excellent money, but your credit could be excellent, fair, poor, or nonexistent. I have also seen the inverse with those that make less money as well in addition to those in the middle of the income ranges, I have seen. A concept that eludes some of us is the concept of having limited credit.

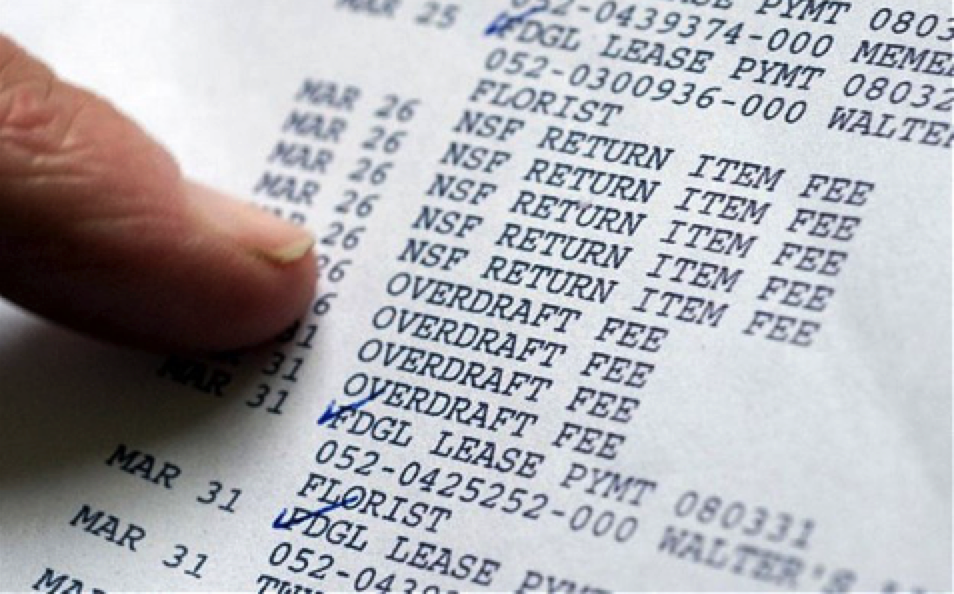

The terms “limited credit” and “no credit” are typically used synonymously to describe anyone who has not been the primary account holder on a credit card or loan for three years. This is something commonly seen with those that have bought everything with cash only or just never had a need to get anything on credit. Additionally, some lenders might not even report to the credit bureau which is what sometimes is referred to as “invisible credit”. If you suspect your credit history is insufficient because of a data problem, contact your lenders and check whether your personal information on file with them is correct (i.e. name, date of birth, social security number, etc.).

Lending companies/financial institutions give inexperienced consumers the benefit of the doubt to a certain extent in that the terms they offer them are better than those given to people with bad credit. However, you must demonstrate the ability to consistently make on-time payments to your monthly financial obligations as well as maintain balances below your credit limits in order to build the requisite credit history to be trusted with higher credit lines as well as competitive rates and rewards. An example of this would be if someone with limited credit requests a loan for a new auto. With zero history (keeping in mind your credit report is like your report card for your credit) it isn’t normal to see high balance loans for an auto with such limited history (unless there is a very good strong cosigner or a significant down payment). Without a down payment or cosigner, there’s a good chance that you could end up with a smaller car loan to start out (even if you make excellent money) due to the lack of history to prove creditworthiness based on the risk to the lender or receive a denial for credit. Once the loan has been successfully paid off (and provided a great pay history) that loan could be used as the basis for another perhaps larger loan in the future.

No matter what age you are or where you are in your credit-building journey, a lender typically relies on a credit score to help decide whether to approve you for a credit card or loan. There are numerous ways today to build your credit. From online banks to even your own bank or credit union there are programs designed to start off your credit journey before your next big purchase. From share-secured loans to secured credit cards, there are ample opportunities to build credit in today’s times. Consult your local bank/credit union for different credit building products to help you in your financial journey. Until the next time dear readers. Excelsior!