In the world of credit there are many different factors that build and tear down a score. One common conversation I often have in regards to credit is regarding inquiries. There are many misconceptions as to what an inquiry is and I will explain and debunk these misconceptions in this post.

Inquiries are entries that appear on your credit report when your credit information is accessed by a legally authorized person or organization (including yourself). Most commonly, inquiries are the result of an application for credit, goods or services, an account review made by a company that you already do business with, or a preapproved offer of credit that has been sent to you.

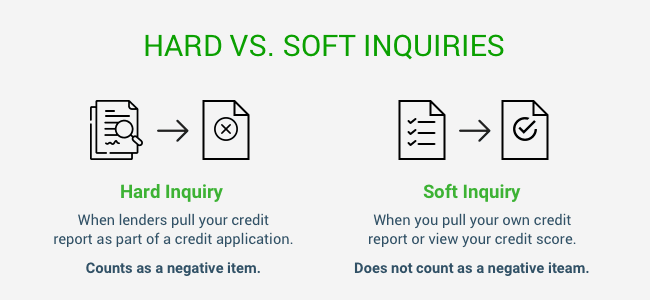

There are two types of credit inquiries: hard inquiries and soft inquiries. Account reviews and preapproved offers fall under the category of soft inquiries, which have no effect on your credit scores. Hard inquiries include applications for credit or certain services, and although their impact is minimal, they can temporarily affect your scores. It is good practice to get your credit report checked throughout the year to view hard and soft inquiries.

A hard inquiry appears on your credit report when a lender checks your credit in response to an application for a new loan, credit card or line of credit. Whenever you seek new credit, there’s the potential for a new debt, which may temporarily lower scores slightly until you can show that you are managing that new debt responsibly. Credit scoring models such as those from FICO or Vantage sometimes account for that increase in risk by lowering your scores slightly. Typically, most score models show hard inquiries typically lowering scores by less than five points.

Hard inquiries remain on your credit report for up to two years, but as long as you keep up with your payments, credit scores often rebound from an inquiry within a few months. And, most credit scoring models no longer count a hard inquiry in score calculations at all after 12 months.

Soft inquiries appear on your credit report when someone runs a credit check for reasons unrelated to lending you money. These events are not associated with greater repayment risk, so they have no effect on your credit scores. Common examples include but are not limited to: utility companies for services and equipment, auto insurance companies, credit card companies that you have accounts with currently, as well as a credit review with a lender in a bank or credit union.

It is ideal not to accumulate too many inquiries as they can lower your scores over time if one is rapidly shopping for credit. There are an exception to this however. If there are multiple inquires from a car dealership to other lenders when you finance a car (this is called shotgunning the credit as it goes to mulltiple lenders) within a certain period of time it is counted as one inquiry. Inversely, if there are multiple inquires foe different types of credit in a period of time that is a sign of concern to a lender. It is important to check your score reports at least once a year to ensure all inquires on your report were authorized as unfamiliar inquiry activity could be a sign of either an error or criminal activity. You can review your annual credit report for free Here.

Inquiries are as I call the “cost of admission to credit”. These inquires make up a small percentage of your credit score but it is important to not go overboard with shipping for credit and recognize that even if they are small, inquires can still have an effect on your credit score. Until the next time dear readers, excelsior.