Savings are an important thing in life that is often neglected. Did you know the average American has less than $400 in their savings? This is an alarming number due to the simple fact that life is full of unexpected things and anything can and will happen so you must be prepared. Learning how to save no matter your situation will help you in the long run. Oftentimes I’ve heard “I’ll start saving later”, sometimes later could be too late. Too often do we wonder “where has my money gone?” it’s time to stop wondering and time to start telling your money where it needs to go. With that, there is no time like the present so let’s begin, shall we?

The first step in achieving your savings goal is to make a budget. Making a budget isn’t difficult, but it can seem daunting if your finances need a big overhaul and you’re desperately trying to build up your net worth. There are plenty of helpful budgeting tools to get you on the right path, but the most important thing to remember is to make your budget realistic. When you’re trying to decide what to cut from your current spending, look for things you know you can live comfortably without. That means getting rid of your magazine subscriptions, cable, home phone, trips to the nail salon, or anything else that’s more of a want than a need. After you’ve made those cuts, divide your income into three piles: one to pay your bills and necessities with, one for savings, and one just for fun. Too strict of a budget will drive you crazy, and the best way to maintain good financial habits is by rewarding yourself, even if it’s just with a fancy latte or new outfit from time to time. It’s important to keep yourself financially healthy but it’s also important to treat yourself from time to time for your hard work.

One thing to keep in mind is your why: why are you saving? Keep a goal in mind and you’ll be more likely to reach it by tracking it with your budget. Even if you make the most amazing budget in the world, without setting any specific savings goals, the chances of you sticking to your budget are slim. Do you want to save up to buy a home? Pay down your student loan or credit card debt? Quit your job so you can backpack around Southeast Asia for a year? Keep yourself a rainy-day fund? Whatever your goals are, give them price tags and deadlines to give your budget purpose and to keep you motivated.

There are several “terms” of savings to keep in mind here: emergency, short term savings, midterm, long term, and retirement. The emergency fund is, as the name implies, is for EMERGENCIES only. Things such as your car breaking down and needing repair, your furnace at home breaking, medical emergencies and other things of that nature. When life throws a wrench into your works you need to be prepared to get the wrench out.

Short term savings are for things you know are coming up very soon (like within the next weeks or months up to 3 years max) these funds are readily available to be used for things that are small but you know they’re things that could happen but you are prepared for them. I call it the “surprise!” fund but others could call it the sinking fund. Things that pop up such as a family member in need, a bridal shower gift you forgot to get, or things to that extent. This is commonly referred to as the sinking fund which is separate from the emergency fund due to it being something you can use for more fun things as well such as a vacation. Ideally, you want to be prepared for big emergencies, so the “surprise” fund is something I’d put second to your emergency fund.

Midterm savings are things you would plan for that aren’t an immediate event such as buying a new or used vehicle cash or having the startup funds for a business. These things are a year to 5 years out even up to 10 years. Instead of getting into debt with a loan it can help to establish savings for those big-ticket items so that way you have little to no debt for those larger expenditures.

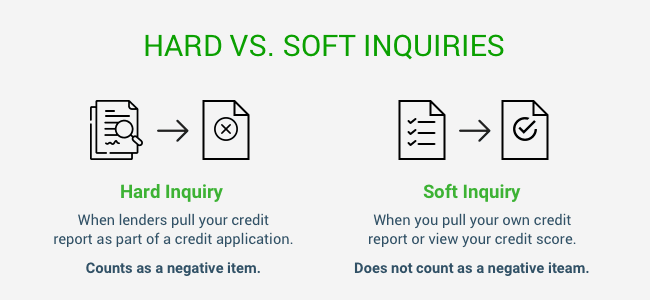

Long term savings are more dedicated to things happening 10 or more years out. One such thing would be your planning to buy a home. Some save up for cash down payments on their home and you can also buy your home outright depending on the home’s price. A good way to ensure good savings for this goal would be a CD so your money is earning more interest while you’re waiting or placing it into an investment fund on some sort depending on your risk tolerance.

Another form of long-term savings is your retirement savings. As I mentioned with my previous IRA series you also have your 401k if your employer offers it or any other type of employer-sponsored retirement plan. You can also invest in a mutual fund or brokerage account with countless firms and funds for your retirement supplementation. Your employer might offer you matching for your retirement plan, it would be ideal to take the maximum match for stuffing your nest egg. Fidelity recommends placing at least 15 percent of your income into a retirement plan, this sounds like a lot but with payroll deductions and automatic transfers into such an account, it makes it easier to put away for retirement.

I know what you might be thinking: how do I do that with all my different expenses and such? The answer lies in several different methods. One method would be having multiple savings accounts for your different purposes, akin to Dave Ramsey’s envelope system but only digitally. Setting up automatic transfers into these separate savings accounts will help you fill the different buckets for achieving your goals. Other cool tools are CDs for mid and long-term saving tools that you cannot touch without penalty to give you more incentive not to touch the money you’ve purposed. Even establishing a separate account for out of sight out of mind savings helps keep you honest and on task.

I hope this basic overview of savings helps spark an idea as to how you can save money for your future. Money is the most renewable resource that someone can obtain. No matter how much you earn you can save with a plan and dedication. Commit to save and you can achieve your goals. That is all for now, until the next time, invest wisely my friends.

/what-happens-if-you-dont-pay-a-collection-960591-v3-5bbe02b546e0fb00510fde7e.png)