In the world of business and in the life and times of the rich and fabulous, there comes a time where one must conduct themselves with refinement and poise. This goes a step past dressing and talking the part of being a professional. Little things such as your posture and eye contact can make or break a deal. The topic I’ll be covering today will be on fine dining etiquette.

- Entering the fray

Let’s say you get an invite to your boss’ board dinner or maybe you score a lunch meeting with someone you’re looking to get a job with, congrats to you on that opportunity. Now we must set the stage on making sure you’re not eating like you are a caveperson in front of them and making them think you’re gross. The first step is to properly make the introduction, if you read my last post on “impressionable minds” you’ll recall the steps to a proper first impression. The same rule applies here. Do some research on the people you’ll be dining with for good info for conversation. Next make sure when you greet that you keep it on a last name basis unless they give you permission to use their first name (Mr./Ms. Executive). If you forget their name by chance don’t panic, just admit it gracefully and go on with your conversation and if you can’t pronounce their name it never hurts to ask! Also while we are in the introduction phase and everyone is being seated be sure to not just sit anywhere, try to sit near the host for maximum exposure and also check for reserved seats so you don’t step out of line!

- Placement

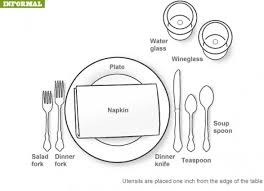

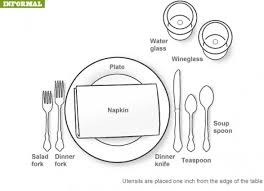

Now that we’re at the table let’s talk about where things go on the table. Take your napkin on your lap immediately after everyone is seated. In the event of you needing to leave the table take your napkin and place it on your chair to indicate you’ll return soon. Upon the end of the meal then place the napkin on the table to indicate you’re finished and ready to go.

Next look at the silverware on your tale. The number of utensils depends on the number of courses being served, you’re going to work from the right side in start furthest from the plate. Properly hold your silverware lie a pencil and don’t wave your silverware around in the air while gesturing, you don’t want to scare people holding your knife like the second coming of Michael Meyers. Once you pick up a silverware piece make sure not to put it down until you’re finished with it and if you drop it leave it and ask for another. You may or may not have glasses for drinking and the same rules apply (usually there are 2-3 glasses, each for water and possibly wines so pay attention to when it’s appropriate to make use of those). To conclude the topic of posture let me remind you that your body posture is just as important as your table placement so do not slouch, keep your elbows off the table and eat at the pace of the table because your posture is important as your performance.

- Conversation

Now we get to the fun stuff, the art of the conversation with your table and your waiter. In regards to your waiter/ waitress please be sure to be courteous and make eye contact with them if you need anything. When ordering be sure not to order the most or least expensive item on the menu, you don’t want to seem cheap or a spendthrift. Ask the host if they’ve eaten at the venue before and see what they recommend but keep two different items in mind and after the host orders order accordingly. Do not order alcohol during the meal, treat this like an interview and have water or a pop (that’s soda for you non Michigan folks reading this). Please be sure to avoid messy foods that might get everywhere i.e. spaghetti or sandwiches, think knife and fork food.

Now let’s talk about your conversation game, you’re not going get far if you can’t talk properly to people. A good conversationalist is above all, polite. Be sure that you’re being an active listener and acknowledge people as they speak to you. Ask good questions, in fact try “echoing” (I say I fly model airplanes and explain a little about how I build them and you ask a question like “so you spend x hours building a plane?”) this method shows that you’re paying attention to the topic at hand. Don’t interrupt people when they’re talking to you, it’s rude and be sure to make eye contact and not let your eyes wander around the room when people address you directly, be in the moment. If someone gives you a compliment gracefully give a thank you and extend compliments genuinely and for the love of all things pure and holy do not broach the topic of politics, sex, religion or anything marked as “things to make a conversation go from civil to civil war real quick”. If things get stale and people are tuning out just change the subject appropriately and don’t open the “business” topics until it’s time to do so.

- The food

Now let’s get ready to dive into the grub hub folks. Chances are at a fancy restaurant or business dinner you are going to have several courses. I know you might be a starvin’ marvin if you get to the table but please wait until everyone is seated and the host starts eating first or encourages you to eat so you’re not being rude. Pro tip: make sure to pass food to the right and pass the salt and pepper together and anything like creamers or syrup pitchers should be given handle first to the recipient. This is still part of the interview!

If you have salad be sure to use the salad fork unless the salad is the main course. If you have something in the salad you don’t like eat around it, DO NOT pick it out. If you need to cut your salad with a knife do it bit by bit. If you have bread at the table tear the bread with your fingers, butter while the bread is on the plate when the butter dish is passed and eat one piece at a time instead of all at once. If you have soup make sure to move the soup spoon away from you toward the center of the back of the bowl. Make sure if crackers are present not to crush them in bag before dumping them into the soup (that works better in chilli anyway), one piece at a time. The soup bowl may be tipped away from you to fill the spoon with the last sips of soup so no using your face and no slurping! Once you’re done place the spoon on the plate underneath the bowl while resting when finished

Time for the main course now. Be sure that you cut your meat and eat one bite at a time instead of all at once. Remove small objects such as pits, fish bones etc. from your mouth quickly with your fingers and place them on the edge of the plate. Don’t use a toothpick at the table, go in private to use it to get things lodged in the teeth. Also make sure to remove sizzle sticks or spoons before taking a drink. Lastly, contrary to our budgets and taste buds, if the portions are too big resist the urge to order the waiter to wrap up your food if you can’t finish it, it’s not appropriate in this context.

5. Conclusion of the meal

Once you’re done eating place the knife and fork in the “finished “ position (10:20 position, tips of the utensils at 10 o’clock and handles at 4 o’clock. Leave the plates as they were presented, I know you want to stack them up or push them away but that is frowned upon in this context of fine dining. After the meal be sure to follow up with a thank you to the host after the meal and thank you cards within the next 24 hours, try to do it by hand if possible unless you have abysmal handwriting.And there you have it, now you know how to “eat like a pro”, for your reference I have a sample table placement of what your table could look like.

Until the next time I wish you the best of success. Stay tuned for next time when I cover more of the proper ways to navigate to big bad business world. Excelsior!