In this day and age, we can buy things with cash, card, check, app, wires and even your signature on a dotted line. How so on the latter you ask? With credit of course! Credit is a topic that some would like to avoid or don’t know about or are cozy discussing. As someone who works in banking/finance I am not afraid to discuss the importance of credit and what it can do for you.

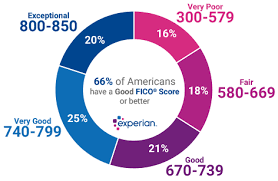

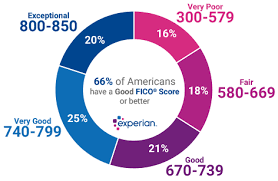

Credit is determined by many factors. You’ll hear the term “credit score” thrown around a lot these days. A credit score summarizes your credit risk based on a snapshot of your credit report at a particular point of time. So essentially, it’s a screening process to see how responsible you are in managing debt to see if a lender can take a chance on giving you financing for your desired purchase. Credit scores are often called FICO (fair isaaac & Company) scores because most credit bureau scores used in the US are produced by software developed by FICO. Keep in mind that not every score you buy online (or view on credit karma) is a true FICO score. Credit scores range from 300 to 850 and are calculated by a mathematical equation that evaluates information from your credit report. The higher your score the better your chances are for getting financing for whatever you’re looking for.

Here in the good ol’ US of A we have 3 national credit bureaus (Equifax, Experian and Transunion) that compete to capture, update, and store credit histories on most US consumers. While most of the information collected is similar, there are some differences in what information is captured and how things are displayed by each bureau causing each score to be different from each other. Then if you add in sites like credit karma (which I enjoy because it’s free) or credit sesame that track using their own metrics you could have a lot of confusing variants on your score. Your credit karma might be 642 but Experian says you’re a 720, Equifax says you’re a 772 and Transunion will say you’re a 843. Confusing right? Even a variance of 20 points can make a huge difference. While each source has different scoring metrics there are some general guidelines for determining your credit score.

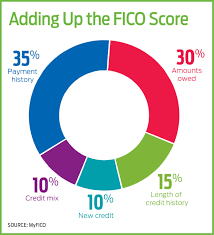

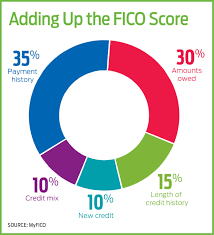

Your score is determined by your payment history (35%), amounts owed (30%), length of credit (15%), new credit (10%), and types of credit (10%). The most important factor in determining your score, your payment history, is simply a record of whether you’ve paid your bills ( I must further stress not only regular bills but things revolving your credit like your car notes and credit cards, etc.) on time. The second more important, the amount owed, is a little more complicated. It looks at how much you’re using of the total credit you have available – also known as your “utilization ratio” or “capacity”. Lenders believe that borrowers who are close to maxing out their credit are more likely to miss payments due to using a lot of their capacity (it’s a good idea not to use more than 30% capacity i.e. $300 on a $1,000 card). The third factor, length of history, is determined by the average age of your accounts, as well as how long it’s been since those accounts were used (like your favorite wine or steak, credit gets better with age). The two smallest factors are how often you’ve opened new accounts (opening a bunch at once will hurt your score in addition to too many inquiries on your credit), and whether you’ve got a mix of different types of credit (such as a mortgage, student loan and car loan). Lenders like to know that you can manage different kinds of accounts responsibly. As long as you keep these factors in mind when obtaining credit, you’ll be well on your road to having excellent credit.

One other factor in keeping excellent credit is also knowing that life happens and so do mistakes. Sometimes people make mistakes in the bureaus and it’s up to you to call them out on any mistakes you find on your credit report (such as payments being reported wrong or new accounts opened that you didn’t ever open, etc.). you have a right to dispute any inaccurate information on your credit report and if you do find anything out of the ordinary you can contact the consumer reporting agency. It’s always a good idea to keep an eye on your credit to make sure that information contained therein is accurate. Under federal law you have the right to obtain a free copy of your credit report each year from the national consumer reporting agencies once a year. You can use the following methods:

By phone: call toll free 1-877-322-8228

On the net: www.annualcreditreport.com

By snail mail: send a completed annual credit report request form to:

Annual credit report request service

P.O. Box 105281

Atlanta, GA 30348-5281

Another tool for your utility belt you can use is the Consumer Financial Protection Bureau’s website www.consumerfinance.gov/learnmore to learn more about credit reports and your rights under the law.

Credit can seem like a scary thing and there’s always more that can be learned but with the basics on managing your credit you’ll be well equipped to begin your journey into using this tool properly for your goals.

Use Credit Responsibly my friends!