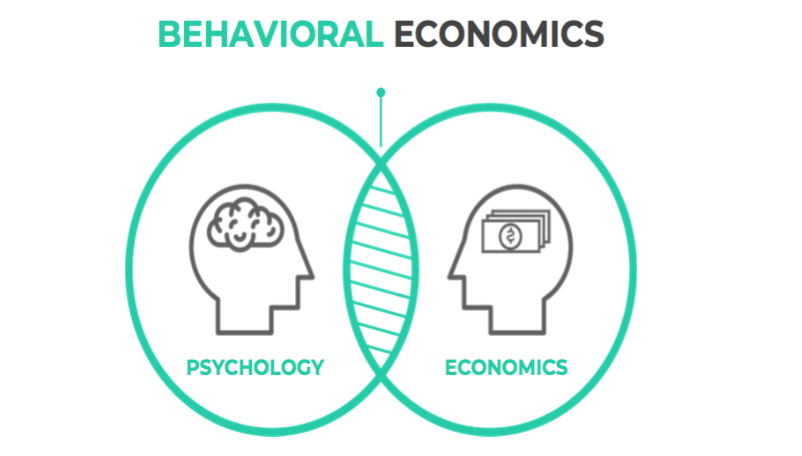

I have covered a variety of financial topics in many posts, but it has come to my attention that there is one topic that is the foundation of financial education. Everyone has a philosophy of life, habits, proclivities, and leanings towards various ways that they live life. This applies to money and our spending habits as well as our beliefs about money. This concept is known as behavioral economics, and this is prevalent in our day-to-day life in ways that you may not realize.

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural, and social factors on the decisions of individuals and institutions and how those decisions vary from those implied by classical economic theory. This studies how people react when markets and other economic changes drive decision-making made amongst consumers. Common examples of this would be the supply and demand of PlayStation 5 consoles. There is consistent demand for the consoles and the supply is never stable enough courtesy of scalpers and others who have bought them. This would drive the consumer to either wait for the demand to drop and supply to increase (such as yours truly) or pay a higher premium for one from another source such as eBay. Another example would be the toilet paper shortage during the beginning of the coronavirus pandemic among other supply shortages courtesy of panic buying considering world events and fears of lacking supplies for survival. These purchases were made based on scarcity, excitement, and fear. Scarcity makes a consumer value something more because it’s in limited supply and some might be willing to pay more for it or if one is willing to wait, they can delay that gratification until a later date.

Our beliefs about money can be formed by the market as well as by those around us. Growing up, we’ve all seen how our parents have handled money and their financial choices for better or worse. These experiences can shape our own viewpoints and we can also study more on our own to learn more about finance. From a coupon clipper, a shopaholic, a minimalistic saver, or a person who likes to enjoy the finer things in life. This can be found in our spending as well as investing style from a more conservative investor buying growth/value stocks to a more aggressive investor looking for growth in more speculative stocks. Some may be more risk and loss averse while others may not be and that can shape decision-making in terms of investing and spending. Some may be more prone to impulse and spend their funds for whatever might be seen. Some may subscribe to the prospect of hustle culture and building streams of income. Some may be more content to have the essentials and nothing more and that is fine for them. Others might think that wealth corrupts and might be more financially inclined to not aspire for wealth to excess. Our social circles also can help determine our financial potential. From friends who always go on lavish nights on the town to those who are content to have a game night a home. The choices of those around us can be another influencing factor.

No matter the school of thought regarding money, it is imperative that we continue to educate ourselves about how money works and how to leverage it as needed. Without proper financial education, there is stagnation and no growth. Without that growth, we cannot reach our full financial potential in whatever walk of life we may be in. I encourage you, dear reader, to evaluate your feelings when making your next purchase. Is it vital to survival? Can the purchase be delayed if needed? Can you afford to go out on the town with friends? Are you hitting your savings and investing goals? I urge you to examine your spending habits and evaluate your goals and see how you can reach what you are seeking to accomplish financially. Until the next time dear reader. Excelsior!