In my few years in my banking career I have seen many things but one thing that breaks my heart it is seeing someone without a beneficiary for their funds. This simple step can lead you to avoiding months if not years of hassle with the courts (or even court costs if necessary). It is relatively simple process that I preach on constantly whenever I see it, so get ready for me to get back on my soap box once again.

During this trying time, bank accounts, insurance accounts, brokerage accounts, retirement accounts, you name it. The sheer number of financial institutions that count us as customers may seem staggering and in the rush to open an account, we may have forgotten to add a beneficiary, or even simply postponed that last little detail until it was more convenient (or maybe someone hasn’t thought of one yet). Simply taking the time to ask about it, either you or the agent, will help move the conversation in the right direction for several reasons.

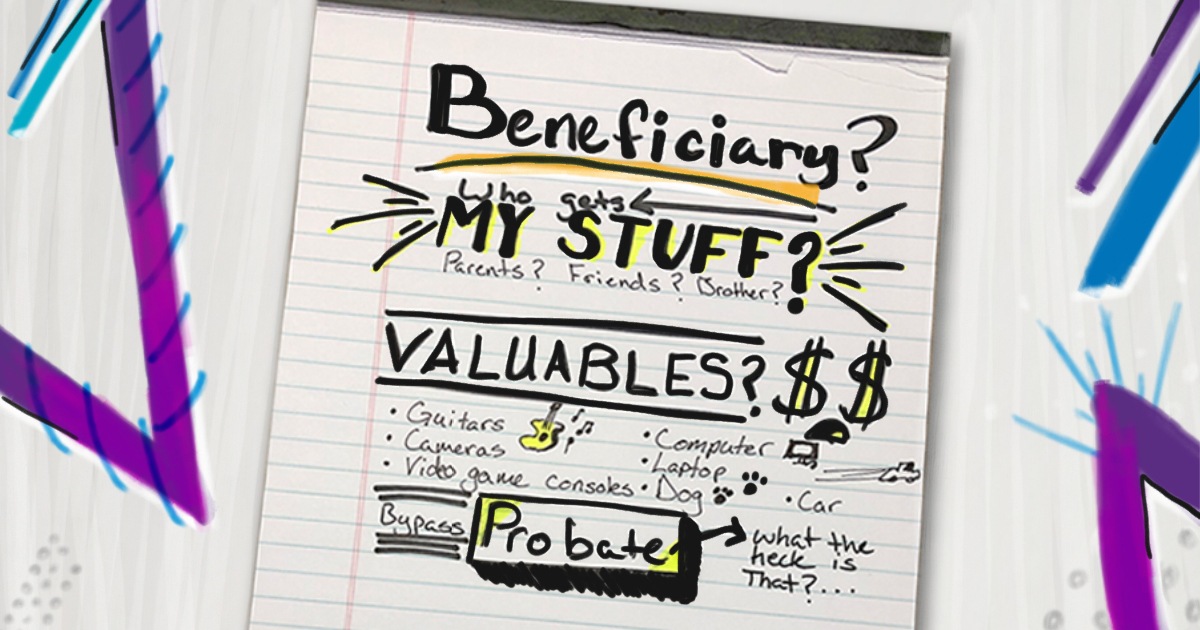

The first reason is that you want to make sure you want the people of your choosing to inherit your money. The person you can list can be a spouse, a child, a relative you trust, or even your trust (we’ll come back to that later don’t you worry). By naming your beneficiaries, you ensure that your money goes where you intend for it to go. That could be to a relative who really needs the financial assistance, a charity that’s close to your heart or whomever you want the money directed to. Without clear directions as to your wishes, executors or the state will follow only what the law says in distributing your assets and that’s not fun. You can name as many beneficiaries as necessary to split the proceeds as well if you would like as well. But do keep in mind if a beneficiary passes or any circumstance arise to compromise the beneficiary that these can be changed in most cases. This way everyone can speed up the probate process (because probate court is not a fun time for your family or the financial institutions reporting process) in addition there’s less going to a court appointed estate to be taken care of.

The second reason is being able to update it on an annual basis. If you’re married, you can almost always change the beneficiary of your accounts without your spouse’s permission. In fact, this is one of the first recommendations I make in a divorce process. The worst that can happen is being forced to put the beneficiary designation back to the previous spouse if ordered by the court or other arrangements. You can change a beneficiary so make sure to periodically check to see if you have a beneficiary listed or if you need to change or add one (my recommendation is once a year or every six months if needed.) This will help for several reasons: 1) it keeps your information up to date 2) you can also use this way to limit family fighting over your assets once you’re gone. 3) Beneficiaries trump wills as well, so make sure you plan accordingly. (contact your estate planer regarding this to make sure things are done appropriately.

Naming a beneficiary is an easy thing to skip over when opening an account, but this small step can save a huge headache – and potentially a lot of money – later. So take an inventory of your financial accounts today, and ensure that your wishes are up to date. Then resolve to keep the accounts updated annually so that you continue to avoid problems for yourself and your heirs. During this time, I urge you now, more than ever. Please get your beneficiaries in order if you haven’t considered it before because we are all human and a simple two-minute process can help save your loved ones from a longer time trying to take care of your estate. Until the next time friends. Stay safe and healthy, Excelsior!

Pingback: Trust funds baby! | Level up your life